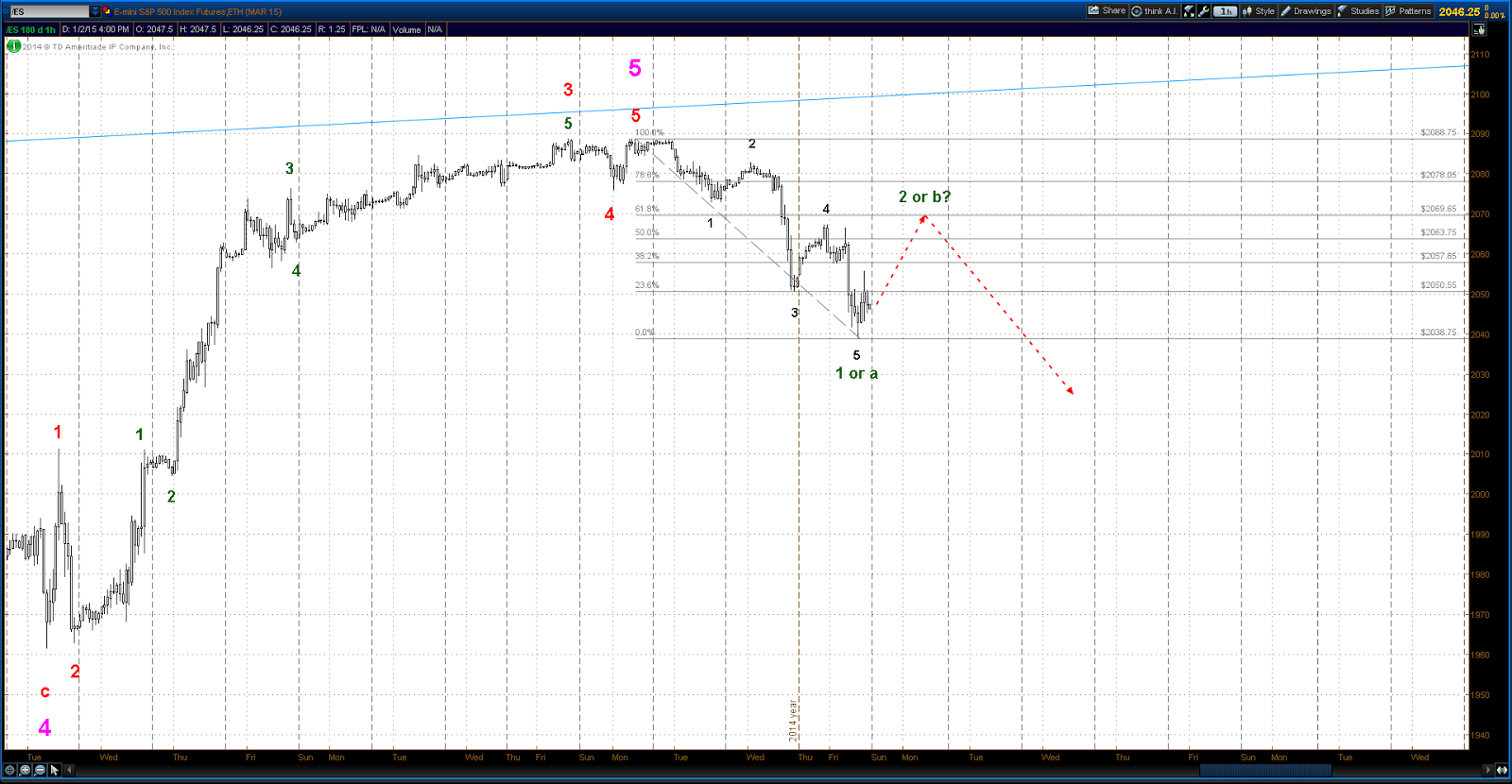

Alternate #1

Alternate #2

The selling that occurred in the last few hours of Friday's session is ominous. The triangle possibility presented on Thursday and in Alternate #2 above (daily charts below) is still on the table but very close to being ruled out. Any serious follow through selling that pushes the ES below the triangle's "C" wave low @ 1970.25 does invalidate that possibility.

The triangle idea was born out of the difficulty in discerning the EW pattern in the muddy mess that the ES has laid out in the last few weeks. The cash (SPX) is somewhat cleaner but still difficult. Especially troublesome is the rally of the week before last. Alternate #1 assumes this rally to be the "c" wave of a flat, in which case it needs to be a 5 wave structure. As can be seen, I can make a 5 wave count out of the structure if I stand on my head while twiddling my thumbs and whistling Dixie. But the fact is that it counts much better as a 3 wave move as in Alternate #2. One thing for sure: it's very much a corrective type move, and the market did in fact embark on a week of bear action after it's conclusion.

However, the odds of the triangle being in play have to be considered low at this point, which leaves Alternate #1. If that's the case, then there could well be a sharp acceleration in the selling giving the set of nested waves 1 & 2 apparent in last week's price action. So buckle your seat belts.

One final note: There are a couple of bullish alternates that are possible here, but until the market shows that they are more probable they will stay in reserve.

Daily Charts

Alternate #1

Alternate #2